Company

ICICI Lombard

Domain

InsurTech

Persona

B2B | Enterprise | SaaS

Duration

4 Months

Research | UX | UI

Bancassurance is a model where banks distribute insurance products through their networks, giving insurers access to a large, trusted customer base. In India, the market reached approximately ₹9 lakh crore INR in 2024, boosted by IRDAI rules allowing banks to partner with up to nine insurers and rising digital adoption. ICICI Lombard, in this case, works with over 200 financial institutions to sell products like health, motor, and group health policies.

However, the process is slowed by 4–6 week partner onboarding cycles, manual lead tracking, fragmented systems, and repeated custom integrations. Compliance updates are hard to roll out across partners, and regulatory risks persist.

ICICI Lombard's bancassurance operations are trapped in a costly, time-intensive cycle where each new banking partner requires 4-6 weeks of bespoke development work to configure products, create custom journeys, build APIs, and establish reporting systems.

This fragmented approach not only delays market entry and suppresses annual premium revenue but also creates operational inefficiencies for both insurers and banking partners,

Designed a SaaS-based configurator for insurance products with partner banks. Enable modular configuration, improve brand consistency, reduce onboarding time.

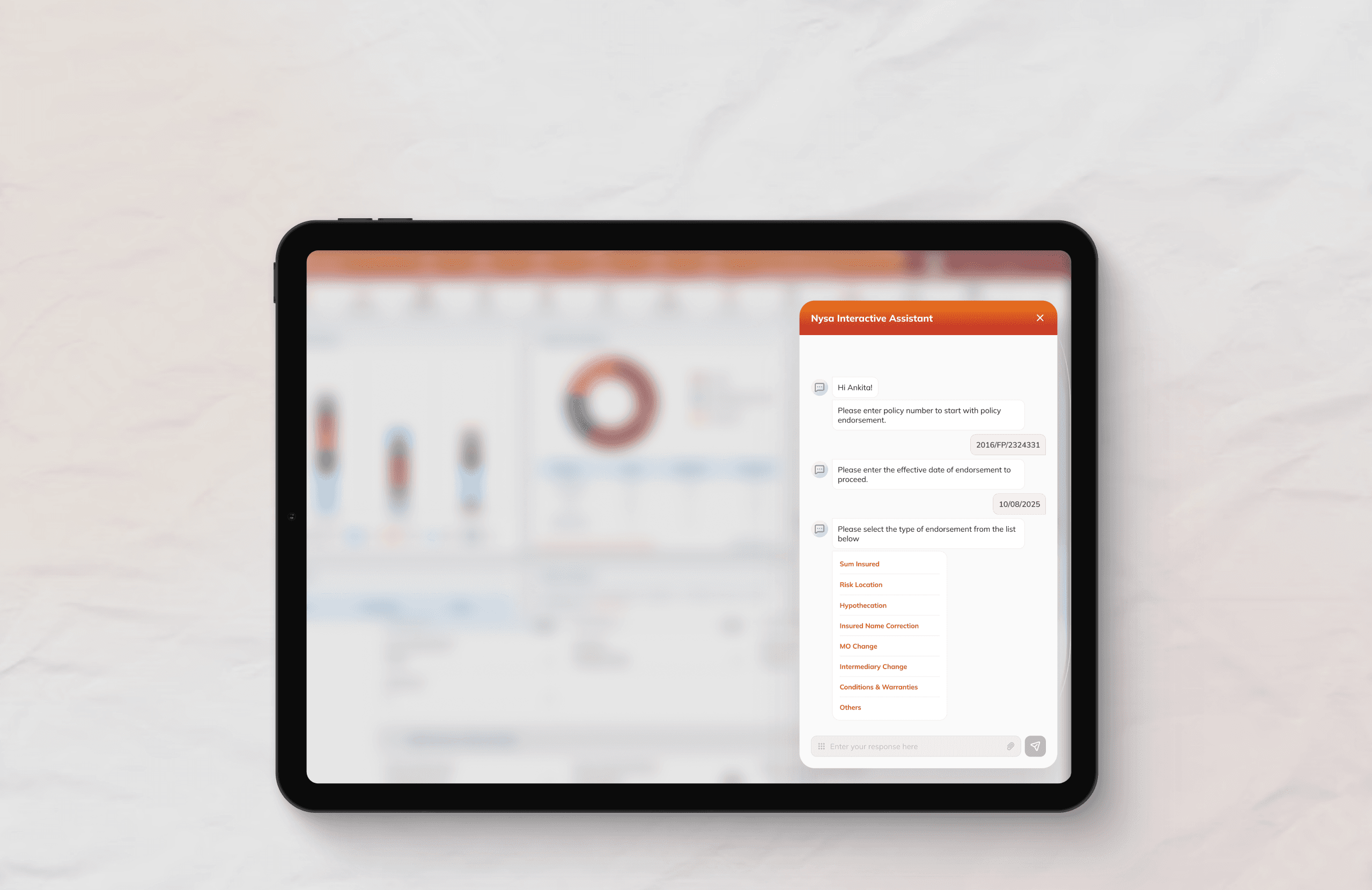

Built a modular, white-label microsite configurator that enabled ICICI Lombard to launch co-branded insurance portals with its banking partners efficiently. The tool unified scattered onboarding journeys and supported branding customizations while reducing dependency on tech teams.

Designed a SaaS-based configurator for insurance products with partner banks. Enable modular configuration, improve brand consistency, reduce onboarding time.

Designed a SaaS-based configurator for insurance products with partner banks. Enable modular configuration, improve brand consistency, reduce onboarding time.

Designed a SaaS-based configurator for insurance products with partner banks. Enable modular configuration, improve brand consistency, reduce onboarding time.